Writing a Will is very important. Below are 12 important points to take care of while writing a Will:

- A Will can be made by anyone above 21 years of age in India. You can make the Will on plain paper in India. It’s not legally necessary to make the will on stamp paper.

- If you die without preparing a WILL in India, your wealth will then be distributed as per Hindu Succession Act, 1956 (for Hindus, Jain, Sikhs and Buddhists) or through Indian Succession Act, 1925 (Indians Christians and other religions).

- When you are dead, there is someone called an “Executor” who will be responsible for dividing your wealth amongst the beneficiaries and he will make sure the whole process is smooth.

- You can change your Will any time you want to. However, make sure that when you make a new Will, you mention that this Will is the latest and supersedes all earlier Wills.

- A “Codicil” is a document that amends, rather than replaces, a previously executed Will. Amendments made by a codicil may add or revoke small provisions (e.g., changing executors), or may completely change the majority, or all, of the gifts under the Will.

- Although registration of Will is not compulsory, it Is highly advisable to do so! Registration of any indenture creates a presumption in its favour. After the death of the person who made the Will, the beneficiaries don't get the property automatically. They have to go to the court and get a “Probate”. Only after the court grants you probate can you become the owners of the property.

- A “Probate” is nothing but a copy of Will, certified under the seal of court. The executor (someone who is responsible to execute the Will) has to file a probate petition in the court of law and if all goes well, the probate takes six months to a year. No right as executor or legatee can be established unless a court has granted the probate of the Will. Probate can be granted only to the executor appointed by the Will. The cost of getting a probate includes legal fees as well as stamp duty on the value of the property being willed. The stamp duty varies from state to state. Probate is very important in case of Real Estate.

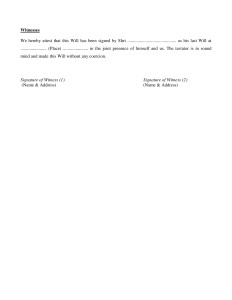

- If possible, have the two witnesses be a doctor and a lawyer. A doctor signing a Will, won’t raise any question of you, being of unsound mind. The lawyer, will vet the will and make sure you don’t make stupid mistakes at the time of writing and signing it.

- The attesting witness and his or her spouse should not be a beneficiary under the terms of your Will. This might create vested interests and sometimes make your Will invalid. Also, make sure the witnesses are younger than you and not very old as your will might be in effect for several years.

- In case of Hindus, it should be clearly stated if the property is inherited or not, because it makes a huge difference, as no ancestral property can be assigned to any person through a Will. All rights on inherited property are acquired by birth. So if you inherited a property from your Father, you cannot say in a Will, that you want to assign it to person X only! It will go to all your legal heirs as it is “Inherited”.

- A Will must always be dated and if more than one Will is made, the one with the latest date will nullify all the previous ones. In fact, there should be a statement in your Will, nullifying all other previous Wills. The pages should be numbered to avoid fraud.

- The value of assets often fluctuates, so it is better to mention how much each beneficiary will receive, in percentage terms rather than absolute numbers. Unless it is pure cash.

How should a Sample Will Template look like? Below are two images, which you can follow: