The Benefits of Education Loan

Every child needs education as they are the future of the world. Every child is entitled to the education of every kind and anywhere in the world, irrespective of the class, status, caste or creed. The demands of the modern world are different from the past, and every child should be prepared to face the world in the true sense. There are a whole lot of benefits when a child gets his education. He educates not only himself to lead a healthy and wealthy life, but also helps to protect the environment, the society as a whole, help to make and also create the world that is beautiful and peaceful.

Here I am giving some useful information about the Education Loan for the child education and its significance

Education loan

Yes, education is not cheap, and there are different education levels that can be seen, such as the primary, secondary, higher and post graduation. The higher you go, the more expensive education becomes. Parents today find it increasingly difficult to pay for the children’s education. However, with so many private and government banks providing loans for education, it has become quite easy and manageable for students to avail them and also repay them.

Details about child education loan

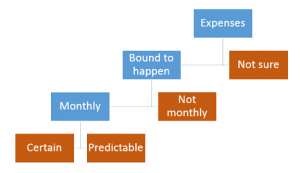

In India the limit for education loan is Rs. 10 to Rs. 20 lakhs. The interest rates on loan vary according to the bank, which ranges from 10 to 14 %. The total 15% of education should be funded by parents, and the balance will be in the form of the loan if the costs cross Rs. 4 lakhs. A third party guarantee is also needed in some cases or additional collateral. Such loans are generally for those who want to study abroad where the tuition fees, hostel accommodations, books, food, etc. are quite expensive. The payments are made directly to the college by the banks. Good performance in academics also provides plus points during the loan process and even the continuation of loans.

Courses for availing loans

There are several college courses within the country and abroad where you can get loans. Some of the courses are medical course, engineering, MBA, etc. These days the banks are unable to get the repayment of the loans and turns into non-performing assets. The scenario is very grave as there is unemployment in most of the sectors. That is why parents are considered for the repayment of the loan rather than the children.

Considerations

Parents should openly discuss the future plans for the children and also the loan and repayment. Most banks provide a pause period where the student can finish education and look out for a job during that pause period. The repayments of loans begin after securing a job or six months after completing the course. If during this period the student is unable to find a job, the parents have to start repaying the loan. Therefore, parents should also be ready for such circumstances.

Benefits of loan for education

There are several benefits if you get a loan for education Firstly, you can educate your child, even when you are in a financial crunch. Your child will get the best education and have a bright future as well. Secondly, you also get tax benefits on an education loan. Under section 80E, the interest paid on the loan is eligible for the deduction of tax on the income. The savings in tax can also decrease the cost of the loan. So the higher is the income, the bigger are the tax benefits. You also have to note that the tax benefits are only applied to you or spouse or children and not for interest paid on loans taken for relatives or even siblings.