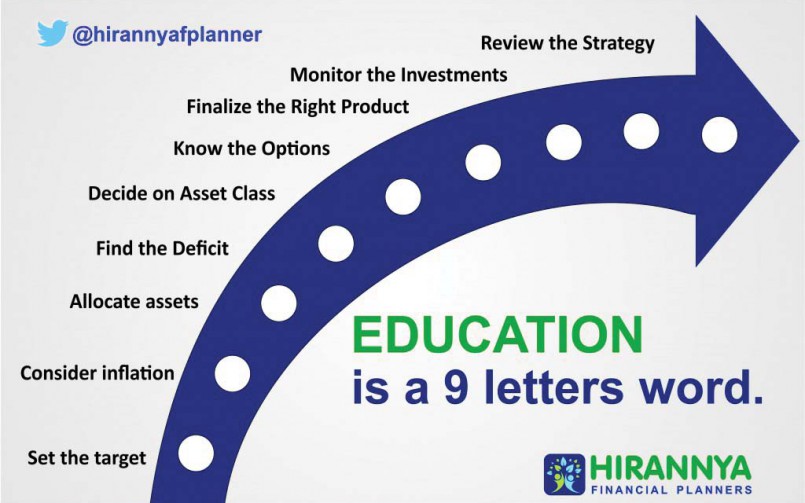

You can do the planning for your child’s higher education all by yourself. Education is a 9 letter word and here is a 9 step guide for you to make sure that you miss nothing while planning for your child –

- Set the target – Think first that the money is required now. If that is the case, then with what amount you would feel comfortable? Say, the amount is Rs. 10 lakhs i.e. the cost as of today.

- Consider inflation – Butthe fact is that you will be requiring the money later, say after 10 years. Then the actual amount which you should have then would surely differ. Blame it on inflation. Again this inflation may not be the same as for other household items. Normally inflation of education cost is always higher. Let us assume it to be 10%. Using simple FV formula in Excel, now you can find out the actual amount which is to be targeted, say Rs. 25 lakhs.

- Allocate assets – If you have already made certain investments keeping this goal in mind, allocate those assets to this goal. How to do that? Say, the asset which you have already made investments in, is Fixed Deposit of Rs. 5 lakhs. Now assume that this deposit is to be renewed for next 10 years till your child becomes 18. You also have to assume the net return (post tax) that can be earned from fixed deposit year on year. So now it can be found out that what amount will be contributed by this asset, say Rs. 10 lakhs.

- Find the Deficit – After allocation of existing assets if there is still a deficit that has to be taken care of. In our above case, there is a deficit of Rs. 15 lakhs (25 – 10). So now you know the task in hand – to accumulate Rs. 15 lakhs in 10 years.

- Know the Options – What are the options that you have now? Before coming to that, make sure that you have listed all your current assets and outstanding liabilities somewhere. Also list your income and expenses in details. Deficit can be met either by making lump sum investment or through regular monthly investment. Looking at your networth and surplus figures, you should take a call here.

- Decide on Asset Class – When you know the deficit and the available time period to accumulate the target corpus, you can easily calculate the required return that your investment portfolio must generate. If it is anything equal to or more than 12% (post tax) return, then your investments have to be market linked – either in direct equities or in mutual or both. But ULIP (Unit Linked Insurance Plan) and Child Policies are strictly no no. If required return is between 8 to 12%, then real estate or high yield bond/debenture could be an option. But such asset class does not allow accumulation through regular monthly investments. If required return is less than 8%, fixed deposit and investment in similar fixed income instruments should be ok.

- Finalize the Right Product – Now when you have already zeroed in on appropriate asset class, finding right product should not be a big problem. There are various websites which can help you to find out top performing mutual funds. But make sure that such list is based on long term (minimum 5 year) performance only. One mutual fund scheme should be ok here. Do not distribute your investments into too many schemes. If total required monthly investment is of significant amount, you can consider more schemes, but make sure that the underlying portfolios do not overlap each other. While finalizing fixed income instrument, credit rating and rate of interest should be looked into above anything else.

- Monitor the Investments – Yes, monitoring the investments is necessary, but not too often. Quarterly taking a stock of all the investments in your portfolio should be fine. Even if some investments are giving sub-optimal returns, it does not mean that you come out of it. Give time to grow your investments. If less return is due to negative market sentiment or for adverse macroeconomic factors, you need not worry actually. If some investments are performing badly for a long stretch while its peers are performing well, you need to take a call then and rejig your portfolio.

- Review the Strategy – Monitoring investments and reviewing strategy are not same. A strategy needs to be reviewed when you realize some of the assumptions gone wrong. It could be expected return from a particular asset class or could be inflation in general. Goal amount itself can change also depending on child’s knack and opportunities available. In such situations you need to recalculate the whole thing and make necessary changes.

Leave a Reply