While in the course of advising people in planning their finances, many a times I encountered doubts and concerns of investors as far as keeping track of their expenses is concerned. Their common feedbacks on this can be summed up in the following three points:

- Where does the money go?

- Planned expenses and actual expenses never match.

- No trend or pattern can be found out the expenses happen every month.

This is a fact and a known issue. Naturally there are recourses available also aplenty. There are apps, software, tools, calculators and so on. But still you fail, still you go out of budget every month, every year. Why? One reason could be as this is a very personal and unique area to address, there cannot be any panacea.Hence ‘one solution for all problems’ approach does not work here.

How can this be addressed then? The answer is – expect the unexpected. Yes, while listing the expenses, we often assume ourselves as machine, devoid of emotion, impulsions and craziness. That is quite impractical and inhuman too. Let’s accept, at times, we all listen to our heart and do things that is devoid of any logic or pattern. But that’s not a mistake. Mistake lies in not accepting that. Actually that is what you are made of. That is YOU. Such crazy actions actually make you different from others. And you are different. So is me. So is he and she. So let’s keep a place for ourselves in our expense list to do crazy things. (Note: we do crazy things, but never go insane. You got it, right?)

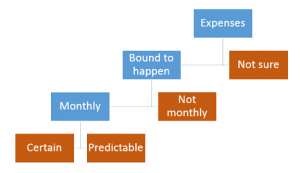

How our expenses look like? I know that is an impossible task, but still you may find some similarities in the below list. While preparing such list, mostly we put different expense heads as categories. Let’s call that bottom-up approach. Let’s try to put it differently now. You can call this top-down approach. Here you go –

So basically you have only four categories to look for:

- Monthly expenses that are bound to happen and you know the accurate figure

- Monthly expenses that are bound to happen and you can safely predict the amount though not accurate

- Non-monthly expenses that are bound to happen – timings and amounts though can either be known already or can be predictable

- Expenses which you are not quite sure of – neither timings, nor amount and sometimes not even categories

So you have four categories to include all your expenses you can think of and not even think of. How to do that? Here is a sample (though actually your could be way different than mine) –

Category 1:

(Monthly expenses that are bound to happen and you know the accurate figure)

Rent, EMI, SIP, Building maintenance or society fee, Dish TV subscription, School fees

Category 2:

(Monthly expenses that are bound to happen and you can safely predict the amount though not accurate)

Grocery, Milk, Electricity, Water, Mobile, Internet

Category 3:

(Non-monthly expenses that are bound to happen – timings and amounts though can either be known already or can be predictable)

Insurance premiums, Annual maintenance, Fees for hiring services of a professional (CA, Financial Planner etc.), Tax outgo, Children’s admission expenses, Membership fees, Birthday and anniversary expenses

Category 4:

(Expenses which you are not quite sure of – neither timings, nor amount)

Dresses and accessories, Repairs, Travelling, Furniture, Electronic gadgets, Medical expenses, Buying gifts for functions, Buying toys for your children, Dining out, Watching movies at multiplex, Buying books and CDs, Getting enrolled for courses

As you have seen by now, you actually cannot do much, except setting money aside, for expenses coming under first three categories. So, watch out, monitor and make provisions for Category 4. That is where the actions happen. And that is what actually makes the difference. As I have said before, yes we do crazy things there but we never go insane. So if you give little more time here, you can surely find out the maximum limits you can go upto for each mentioned expense head in Category 4. Once that is done you can start creating a fund for this category. Then you are most unlikely to go out of budget, ever.

How can you implement this strategy?

Different scenarios are possible here.

Scenario 1: Assuming you and your wife are having two sb a/c each

Keep funds for each category of expenses in different a/c. You would not be required to carry ATM card for Category 1 and Category 3 type of expenses anyway.

Scenario 2: Assuming you are having two sb a/c and your wife is having one.

In one of your accounts keep fund for Category 1 and Category 3 type of expenses together. In other account keep fund for Category 2 type of expenses. And in your wife a/c keep fund for Category 4 type of expenses.

And so on.

What is your contingency fund or emergency fund?

If we assume here, that we are keeping aside 6 months of our unavoidable expenses in contingency fund, then –

Your contingency or emergency fund = (Category 1 + Category 2) * 6 + Category 3

If you have already made provision for Category 3 type of expenses in one separate a/c, then you can keep your contingency fund i.e. (Category 1 + Category 2) * 6 in one liquid fund or in a flexi-fixed deposit.

Leave a Reply