GIVE YOUR CHILD A PROMISING DREAM FUTURE:

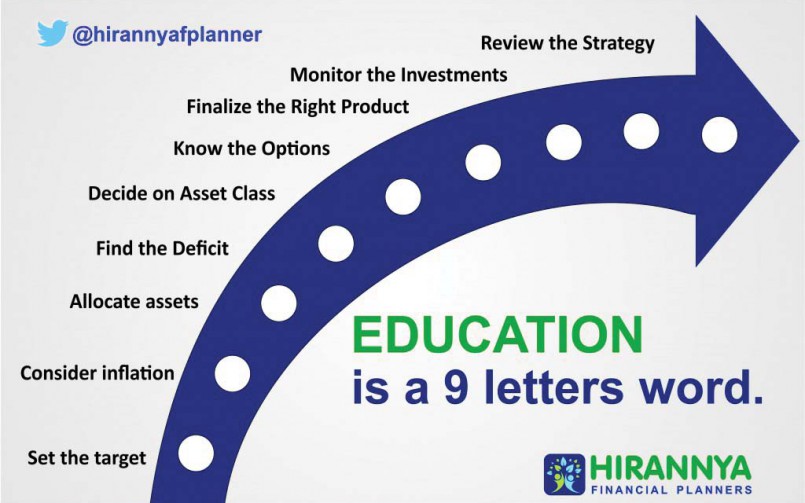

You as a parents dream of fulfilling all the requirements and drams of your kids. You want to give the best to your child. Best of education, best of toys, best of health, best of everything!. The only problem of these best things is that these have the best price tags too. These days Child education is one of the biggest goals of any parents because of the high cost of education and tough competition. It is very important to start saving for your child education. To plan your child’s education check out this ‘education planner’ which will give you an insight on how much you need to save today, to provide for your child’s education at a future date.Cost of education is increasing yearly than inflation. Now a day’s college education is an expensive – but not an impossible one. With the right strategies, you can go a long way to meeting this challenge whether your child is still in preschool or already in high school.

Step No.1: Generally children’s goes to college for under graduation at the age of 19 yrs and post graduation from 22 yrs of age. You can fix your term depending on your child current age and when you want the funds. Now you know the years left for your child higher education..

Step No.2: Every parent has different dreams when it comes to child education. The courses like MBBS, MD, MBA, ENGINGEERING, Technology courses are very expensive one. First assume your child is going to join the college from today then in that case what is the cost of education in today’s value.

Step No.3: Now you know the cost of education in today’s value. But remember the cost of education is going to increase year on year because of inflation. In that case when your child goes to college after some years then find the cost of education will be that time. This is the amount you actually need at that time.

Step No. 4: Once you know the target cost of education then you can start preparing for that. Here you have to take an important step before investing either systematically every month or one time investment. You have to find out whether you can achieve your target with the expected rate of return after adjusting inflation. Everybody has a different investment knowledge and risk appetite. Based on these factors you can choose different investment products to achieve your goal. If you are not comfortable in taking risk then just avoid that investment. Having said that generally equity investments gives better return over long period say 10 yrs and more. You have to satisfy yourself with suitable returns which will be able to achieve your target amount. More importantly if you have more years for your child higher education then you can invest monthly which will reduce your monthly outflow significantly.

Important Decision: Your dream of giving best possible education to your child will be in dream only unless you insure yourself. It is always advisable to take the term insurance plan equal to your target amount. This will take care of your child dream education in case unfortunately if you are not here. Now for more details if you want to start planning for your child dream education planning.